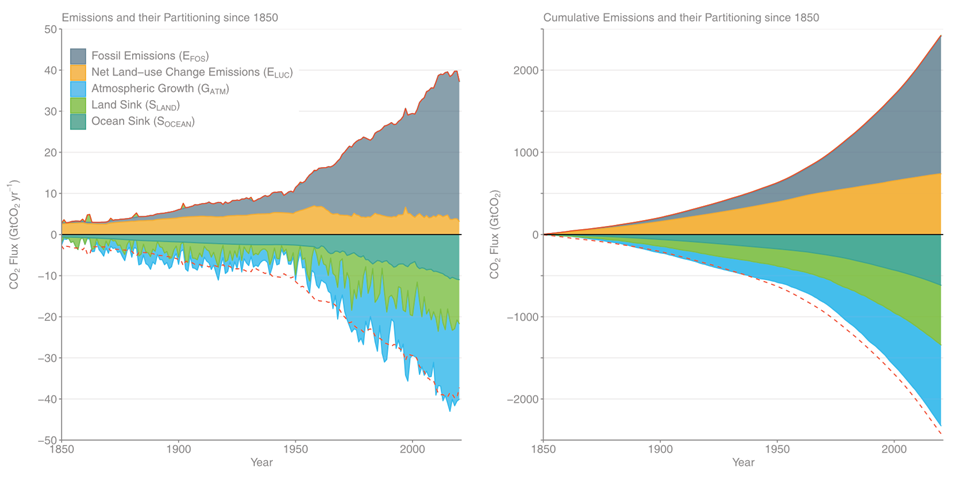

Under the Energy transition process we understand the shift from traditional Energy sources production like burning the Fossil fuels and Oil, which generate main part of CO2 Emmissions in global scale, towards the more green alternatives, which do not signifficantly harm the nature and do not cause the air polution, so much.

CURRENT OUTLOOK

Global energy demand is likely to rise further in the coming years, driven mainly by population growth (the world’s population grows by 80 mil. people each year). So, it is widely perceived that any transition process must also consider this fact in order to avoid any energy delivery outages, which may become more frequent in the future, when relying solely on renewables.

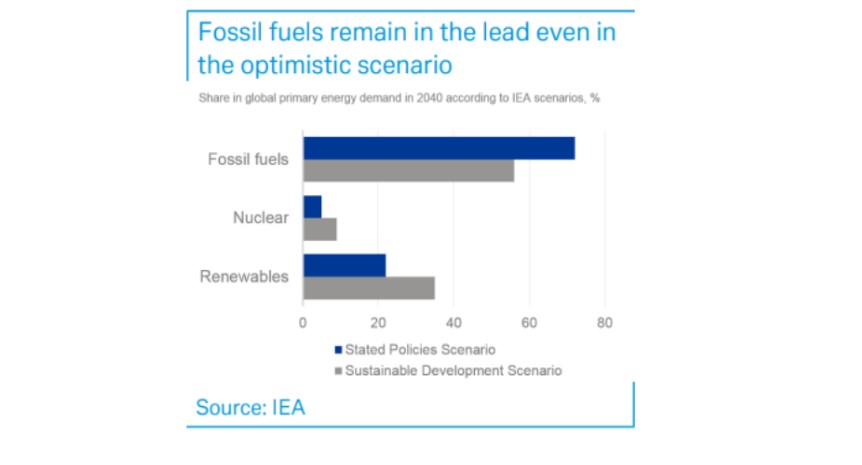

In line with this, it seems more realistic to expect that Fossil fuels will still act as the most important source of energy for upcoming period, though. Even according to the latest Sustainable Development Scenario of the International Energy Agency, Fossil fuels share on primary energy demand is most likely to account for 55% in 2040. On the other hand, IEA expects renewable energy sources to have share of „only“ 35%, thus far away from being the main pillar of global energy supply, as it is presented sometimes in mainstream media. However, this transition process will represent major step how to invent, produce and realize new energy technologies, which will spur also new wave of economic growth connected with this process. Based on that EU policy-makers claim that resulting advantages will prevail over the potential risks and shortcomings.

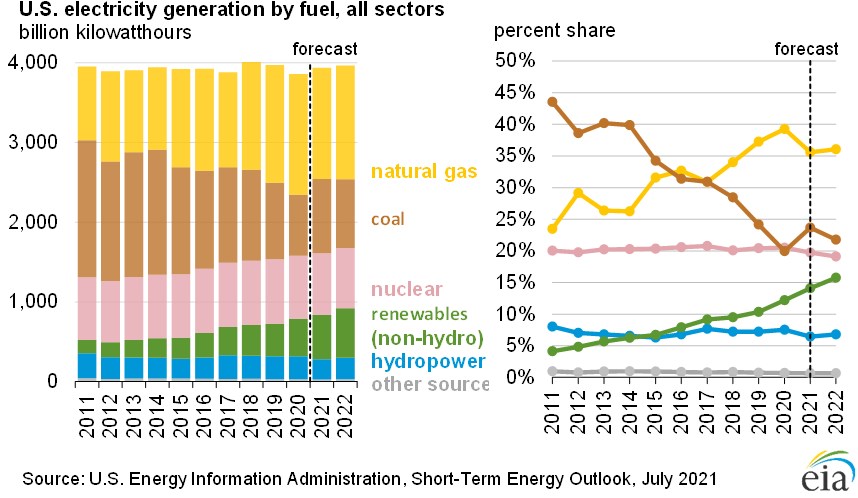

For instance, USA projections for energy production mix forecast that Coal will be replaced with Natural Gas, while Nuclear Energy to remain on 20% share, and Non-hydro Renewables to spike up to 15%. This will for sure represent a major change as Coal energy production made almost 45% just 10 YRS ago.

This shift away from coal represents very positive step in combating the climate change, as coal produces even 2-3 fold more CO2 emissions than Oil alone, for instance. In line with this, U.S. President Biden presented his agenda that for a temporary period, the U.S.A. would increase Oil production to off-set withdrawing from coal energy, which seems from enviromental point of view as still acceptable. Further, such proposal was also made to avoid similar energy shortage situation that EU was facing this winter.

Generally speaking, each Country, Commonwealth or Union will have to create its own energy mix depending on natural resources availability (coal, gas), public acceptance (nuclear) and geopolitical position on global market (when building-up a strong dependency on imported sources).

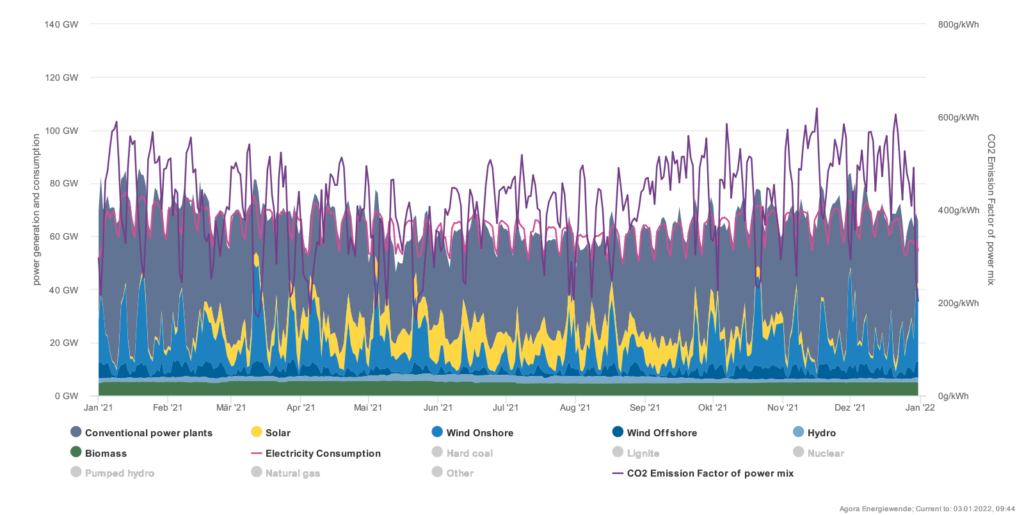

This may become an urgent task for Europe, which decided to become a frontrunner in Energy transition process, so that coal production will be gradually muted, and this will have to be replaced with renewables and nuclear power. As, renewable energy production like wind and solar are still depending on favorable weather conditions, so that they may seem to be convenient for some part of EU continent, mostly. For instance, Wind power stations are heavily efficient in Germany, Denmark, Spain, Portugal, and other countries closer to shore region, where they benefit from stable waves of winds coming from the Ocean and sea. While solar farms have found their home market rather in southern Europe. However, every country or continent needs at least three stable legs on which the Energy production mix will be sustainable for a long-term future, and therefore nuclear energy is expected to play remaining but important part of the role.

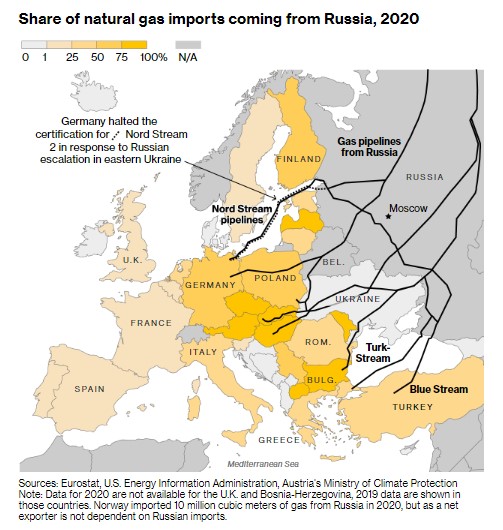

The latter one seems to be very much critical given the latest gas-supply shortages from Russia, which have materialized during the 4Q2021, as a part of political escalations towards EU to provide final usage approval for Nordstream 2. Due to fact that large EU demands for Gas deliveries are not easy to be substituted from other suppliers (Qatar, Norway, Africa etc.), Russia was correctly anticipated to use this “gas” wild-card in its hybrid war with Europe, which has proved to be right during the most recent evolution. Current war conflict in Ukraine has made EU representatives to make decision on phasing-out russian gas supply, which makes entire energy transition even more complicated when compared with initial targets.

Before we make conclusion on how much is current energy strategy realistic, let’s have a look on which alternatives for Energy production are currently in place and what options seem to be most “eco-friendly” going forward. Before we make any conclusion, it is good to understand what the “pros and cons” of each alternative source are.

ENERGY PRODUCTION ALTERNATIVES

a) FOSSIL FUELS

Fossil fuels (like Coal, Oil etc.) are highly reliable, powerful and less expensive for the energy production generation, but their external costs and damaging effect on environmental area are not adequately accounted into their market price, yet. Therefore, Carbon tax prices are supposed to be implemented in a near future to reflect their Carbon footprint, and also the future costs for re-cultivation of used area for a Coal mines will be borne by Coal producers. And this will make the Coal and Oil production more expensive in the end, which will make the transition from these traditional segments and adaptation on new segments quicker.

However, latest studies may show that there may be some exceptions in case of state-owned energy producers, which then tend not to transfer CO2-related costs onto its customers (perhaps from political reasons), like in case of Italian producer, ENEL S.p.a. which was able to internalize only less than 30% of Carbon Tax into the final retail prices. This is substantially lower when compared with other privately-owned market players.

In line with Euro Green Deal, EU countries are supposed to face different transition process depending on their individual dependency on coal production (e.g. Poland – is now generating almost 80% of total energy production from Coal and Coal mines are employing more than 50,000 of workers. So, after agreement with Labor Union, their commitment on closing Coal mines was shifted to 2049; while 2050 was set as final deadline for phasing-out the Coal production in EU. (for instance, Czech Republic agreed to shut down the coal mines by 2038, so effectively 11YRS sooner than Poland).

And even Germany, which has set new standard for more “green” energy policy, will still have to rely on some part of dirty energy when renewables simply are not able to deliver energy during the unfavorable weather conditions. Below attached chart shows the energy production mix during the year in Germany, whereas the conventional production must be clearly substituting the gaps in renewables shortages.

Nevertheless, although we still cannot fully rely on renewables to produce whole part of energy mix, the definitive transition from fossil fuels is very critical as it has major negative affect on our climate. The only question is how and when.

b) RENEWABLES

Renewable energy sources are usualy being labeled those that are generating power from natural sources, that already exist (e.g. wind power, water powerstations and photovoltaics). These are representing rising alternative to traditional (dirty) sources. Their boom in realisation either in small or large scale in recent period is connected with their affordability and growing energy price on the market, so that financial rentability appears to be more secured and even in shorter period, than it used to be. From point of view of impact on environment, these sources are most eco-friendly, however some minor negative effects may be seen, there as well. Especially with solar and photovoltaic systems, the options for recycling their material were very often questionned, previously. But thanks to the massive development, there are already ways how to re-cycle those obsolete glass PV-fragments.

Nevertheless, pure electricity generation costs are only part of the picture, as CAPEX in networks and power storage capacities will need to be increased in order to absorb such enormous increase in energy production from renewable sources, which are quite unstable during the season. And therefore cost-intensive network interventions will take place more frequently. These system wide costs of an increased reliance on renewable energies are often neglected, when it comes to calculations of investment costs.

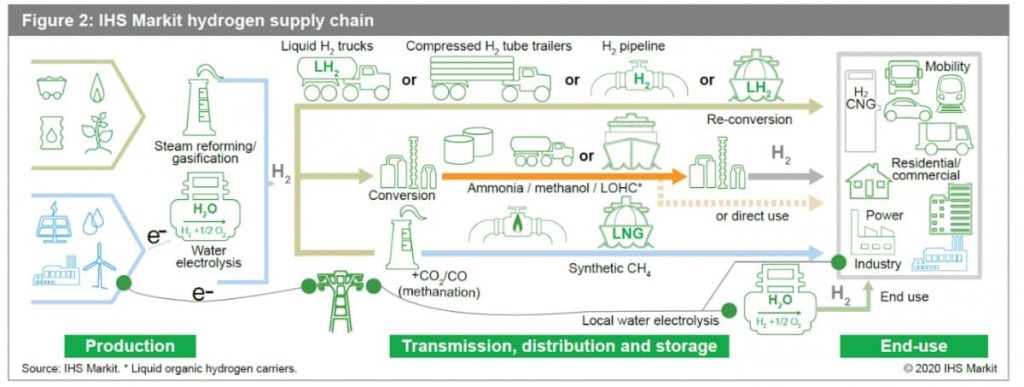

Among the Solar, Wind Farms and Water power-plants which are considered as a main back-bone of Renewables, developed countries are heavily betting on another alternative sources like Hydrogen and Bio-Methan, which are deemed to replace natural gas and/or Oil in the future, but there is still a long way to go for massive scale-up utilization of these sources in practive.

This is due to several reasons, among others that green for instance, Hydrogen:

- Is produced as complementary product to other Renewables facilities,

- It requires quite complex infrastructure from production to storage stage and thus it requires much bigger investment costs leading to higher commodity price itself,

- It is suitable rather for close-end industrial usage from safety reasons, but similarly to LPG cars this may set a new trend, slowly.

Indeed, it seems very likely that Hydrogen will find its own way into the market, currently there are some producers (Toyota, Hyundai, Volvo etc.) already offering personal or light commercial vehicles running on hydrogen instead of gasoline and these trends will for sure continue. On the other hand, higher development costs will be translated into higher purchase price of these cars until the number of sold vehicles exceed some reasonable volume (100.000, 200.000 etc.).

c) NUCLEAR ENERGY

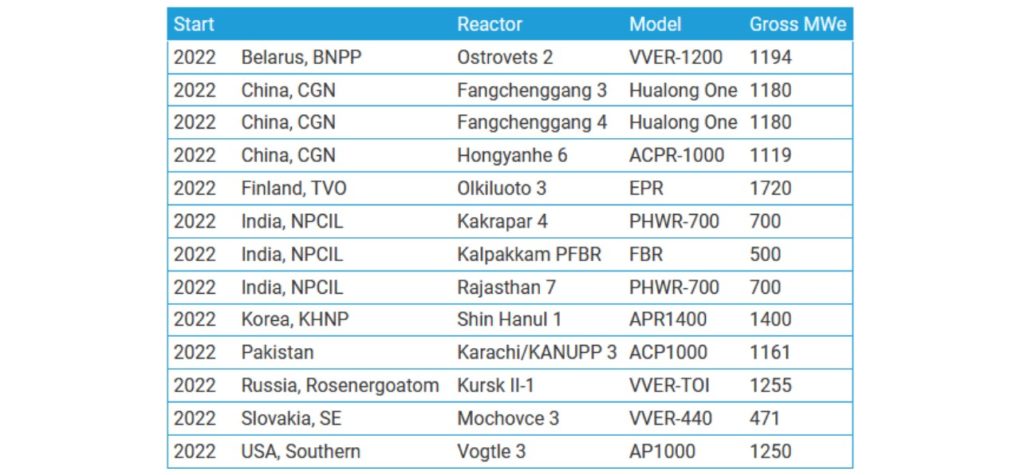

Security issues on one side, but very low carbon emissions on the other side, when discussing the nuclear power plants. So, why we have not been witnessing any steep progress in construction of a new nuclear power stations in Europe, during the latest decades? For instance, below attached sheet displays what are projected Nuclear power-plant completions/ extensions world-wide in current season:

For instance, Areva made dire experience in Finland (Olkiluoto power plant) lastly, whereas the development phase completion was delayed by more than 12 YRS and due to fact that price of whole construction was concluded as fix for entire period and completion costs have exceeded initial budget by EUR 5 bln (excl. financial costs), Arreva was not able to sustain such a loss and had to be „nationalized“ by government-owned EdF in 2016.

And Westinghouse, originally part of General Electric Group, had to be sold in 2006 to Toshiba Corporation in order to be able to continue in business. Nevertheless, Toshiba revelead in 2017 that some extraordinary losses from two ongoing nuclear power plants development in USA have culminated into losses around USD 10 bln and declared for Westinghouse Division an bankruptcy protection (alone costs for Vogtle power plant with two 1,200 MWatt blocks have almost doubled to USD 27 bln). Later on, in 2018 Westinghouse was purchased by Canadian strategic investor Brookfield Business Partners.

And coming back to the initial question, for which the answer is quite complex. Security reasons play a major role here, but they may appear as acceptable given the fact how many power stations are running in the world and only couple of tragical events (Chernobyl, Fukushima) are known to this date.

So, nuclear energy represents reliable source of energy production, but also very expensive as the whole construction of single one nuclear bloc goes into bilions of EUR. And this was quite an issue during the period of global energy excess and lower energy prices (around EUR 20-40 per 1 MWatt) so that any construction of a new power station was calculated to be returned in 30-40 YRS, which is almost double the period with photovoltaics, for instance.

Next to it, there have been also another unclear issues with following aspects:

- development costs – the purchase costs of construction materials have grown up in last decades, so that almost every development of nuclear power-plant that was done in recent years was accompanied with Costs over-run as development phase itself takes couple of years. Based on that it becomes almost „mission impossible“ to properly forecast whole budget for such investment, so that every sponsor is de facto signing a blank check for that. However, this represents problem not only for Sponsor, but also for General Contractor who may face losses from the project, in the end. For instance, that was a case of main global players in nuclear construction activities, like Areva (France) or Westinghouse (US), who have already almost bunkrapted in connection with loss-making projects and must have be overtaken or subsidized by other entities.

- list of acceptable developers/ contractors – this is linked with previous section, whereas besides financial strengh of project general contractor to complete such a capital demanding project, there seems to be also a security risk embeded. In its simplicity, each contractor brings his own know-how, technological standards, requirements for nuclear fuel supplies and waste management, warranty conditions etc. From geopolitical view, it became recently quite unacceptable for EU sponsors to enter into contractual relationship with Russian contractors. So that, the list of global leaders in this field has shortened to only couple of them (a.o. Westinghouse, Areva/Framatome, Siemens, Korean KHNP Group etc.).

- licensing process – given the long-term development period (being close to 10 YRS) and ongoing development of security standards within the EU legislative, there is no guarantee for Sponsors that newly built nuclear power-plant will successfuly get all operating permissions and licenses. Further, Asian-based contractors are more experienced with licensing process in Asia according to local legislative than with European ones.

- hardly predictible energy future price on the market – as mentioned above, the construction costs are very high and development of nuclear power-plants must be deemed as necessary service of public interest, as it should represent important element for securing the stable power generation in the country. In addition, some part of energy generated in nuclear power plants is subject to export to other markets, which represents then signifficant income and with higher energy prices on global markets, the development costs can be repaid in shorter period.

- nuclear waste treatment – represents major burden for ecological system, but there are already local solutions available how to handle and store the waste material in secure way for decades. But very often, such a local wastelands are subject to political fights, where it could be located without having any potential impact on society, in future.

The different stance among EU members on nuclear energy was probably also one reason why the EU Green Deal did not mention nuclear energy going forward, at all. Later on at the beginning of 2022, European Commission delivered directive on which sources of power generation could be classified under the EU Taxanomy. Gas and Nuclear power were to be considered as „green“ under certain circuimstances. Further it was supposed to be accepted only for temporary period, but due to pressure from other EU members this decision was adjusted.

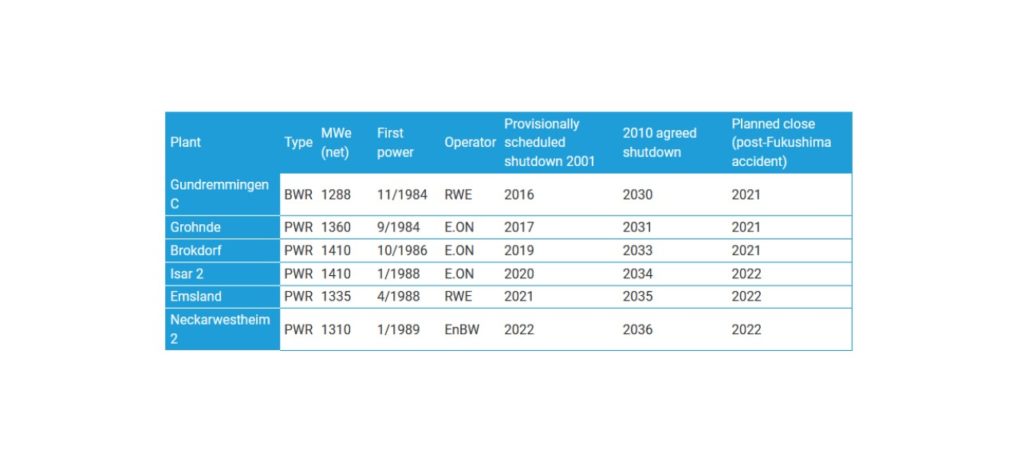

Meanwhile, Germany and its largest energy producers like RWE and e.ON Group are continuing in their „Energiewende“ policy of retreating from the coal and nuclear power plants. During the period 2020-2022 it was anticipated to shut-down such power plants of total output 7.000 MW (for details refer to below attached picture). This should have a positive impact on reducing the carbon footprint by nearly 7 mil tons of CO2 annually (mainly with coal power plants).

Such energy production capacity reduction is supposed to be off-set with renewables, and namely the solar and wind-farms. Alone in 2021, there have been installed 240 tsd. of new PV sources with total output of 5.300 MW. This has added to total production output from solar facilities reaching almost 60.000 MW. And the target remains quite brave, totally 200.000 MW by 2030.

In addition, RWE Group itself aims to invest almost EUR 50 bln into development of new power plants built solely on renewables (a.o. hydrogen, electric batteries, storage facilities etc.).

In contrast to this, nuclear energy remains an (important) pillar of the energy sector countries like France, U.S.A., China or Japan. These countries are also actively researching next-generation nuclear power options. These options include either more effective way how to generate nuclear power or development of smaller modular power stations. The latter one will perhaps become also the future path of Czech Republic, the major energy producer entity CEZ a.s. already introduced similar strategy how to enlarge the production capacity. There was already a memorandum signed between CEZ and other potential suppliers incl. GE Hitachi, EdF, Rolls Royce, KHNP etc., while the targeted aim is to develop small power plant with estimated output of up to 1.000MW after 2040 and there is expectation to place dozens of these modular power plants across our country.

d) NATURAL GAS

For many decades, Gas was considered to be quite affordable energy source due to its relatively lower price and available fields of resources in EU broader continent, resp. sorrounding continents like Middle East, Russia and Northern Africa. Therefore EU consumption of Gas was predominantly relying on these sources, so that energy production from Gas has been reaching to 40% in LT-view (connected mostly with heating needs).

Likewise the Oil, it must be imported from these extraction points through pipelines network, which has been developed across whole Europe and connected countries. But, these pipelines were often built for specific purpose resp. transit of gas from one supplier up to some connection points, wherefrom this used to be distributed further into the grand reserve stations (mainly used by primary buyer). The current EU network and its dependance on import from Russia is displayed below:

Before even War conflict between Russia and Ukraine has started to shape a new EU Energy strategy, some tensions in connection with political game around Nordstream 2 (Joint-venture of Gazprom, OMV, eON and Shell, with total investment costs around USD 11bln) project finalization had been popping-up over the surface. This was due to fact that it was designed to connect Russia and Germany directly through Baltic Sea and thus to avoid Poland or Ukraine on its transition way to minimize the political risks in future. On the contrary, some eastern European countries have been addressing their concern that Russia would try to fully exclude them from gas transition business in the future. For instance, only Ukraine is receiving around USD 3bln annually from transition fees, so that there is no wonder that such a plans to start operating 2nd phase of Nordstream have sparked a lot of controversy around it.

However, it seems as the current War in Ukraine has even accelerated Energy transition process in whole Europe, as the effort to become fully independent from Russian Gas (and Oil) deliveries represent significant game-changer factor. Currently only available alternatives how to substitute Russian energy inputs seem to be importing LNG overseas, which will certainly require notable investments into the needed infrastructure. In case of Czech Republic itself, the best option probably would be to use existing pipe-lines from Germany (OPAL and EUGAL), while the latter one will perhaps remain unutilized as it was originally aimed to be used in connection with Nordstream 2, which does not seem to be put into operation, for now. By means of EUGAL, there would be possibility to deliver LNG from shores of Baltic Sea in Germany, where it can be transported from everywhere. Nevertheless, to facilitate and reload LNG deliveries from cargo ships, there will be needed floating terminals, which have capacities to cover almost 2/3 of annual gas consumption in Czech Republic.

Such terminal is already operating in Latvia, which has helped them to become the first country not depending on Russian gas. Another one will be soon developed in Greece, their purchase price is close to EUR 300 Mio, but vast part of such investments can be funded from EU structural funds. That seems to be most effective and easy way how to replace Russian Gas with LNG deliveries, at reasonable costs. Otherwise, development of a new transition network would require much more investments and would take a lot more time to put into operation (some estimations claim even 2 YRS). Now, it takes swift approach of our leaders and EU policy-makers to launch this process of shifting away from Russia, which will be a real test for keeping their promises and political unity of whole European Union may come into the question, in the end.

THE FUTURE IS NOW

What has been just a couple of months ago designed and drafted under EU Green deal, appears to get much closer, predominantly thanks to war in Ukraine. Having said that, some ideas that might have seen bold and too much distant at that time, may appear now as overdone and will require certain update. But the geopolitical situation is pushing us further to go beyond initial intentions and bring-on more visionary ideas, even in a short-run. If we fail or win in this “dual” fight (with climate changes and Russian aggression), mostly depends on how quickly we will make decisions on shaping the future energy policy.

Nevertheless, some new solutions are already crystalizing in its form and we may say that future is just being shaped, right now.

For example, EU wants to combine faster deployment of renewables, greater energy savings, diversification of supplies from international partners and new tools to accelerate investment in a bid to replace coal, oil and natural gas from Russia. Such plans will require financial package in estimated amount close to EUR 200bln, which could however make positive impact on following:

- to reduce annual spending on Gas, Oil and Coal imports from Russia totaling to EUR 100bln (almost 80% thereof is paid for Gas);

- to raise the target for Clean Energy from 40% to 45% by 2030 (incl. 10 mil. tons of domestic Hydrogen production, additional 10 mil. tons of Hydrogen imports and 35 mil. tons of Biomethane);

- to enhance current Gas infrastructure in order to speed-up the LNG deliveries from overseas eliminating thus the shortages in supplies from Russia and to create solid contingency system;

- and to subsidize development activities of another alternatives in renewables.

What has not been yet discussed in EU, is another way of exploring natural gas from underground sources, using so called “Fracking” method, while it may be expected that such conversation will be opened later, though. Fracking method means Hydraulic fluid, by means of which Natural Gas can be extracted when some chemicals are used to soften the soil and open the “gateway” from bottom up. Based on available information, some potential could be found in Poland, France, Romania etc. However, this method is also connected with strong criticism for:

(i) increased water consumption being used for extraction (according to EPA, USA has consumed up to 500 bln. of litres water each year during this process);

(ii) increased underground soil polution with chemicals (Benzene and SIO2 is released into soil);

(iii) negative impact on sorrounding environment (leading to increased risk of underground de-stabilization resulting into earth-quakes, underground water migration etc.).

Newly emerged focus on renewables is not only seen in EU or U.S.A., but also China understands quite clearly, that if any Country will be able to deliver energy to another countries that are thousands of miles away from its place of origination, then such supplying country may obtain an extremely dangerous power of influence and dominance. This is deemed to be somehow an upgrade of previous “Belt and Road” initiative, which was supposed to improve business connections between Asia and EU countries. Now, China is appearently getting ready to connect ASEAN countries with Japan and Australia with so called UHDC (Ultra high Voltage connection network). Such transcontinental submarine super-grids would enable to deliver power to various countries depending on their current needs and to balance their shortage or excess of energy produced from solar and wind farms.

And they seem to have done their home-work on local market, already. In December 2021, China completed a $3.45 billion, 970-mile-long, 800-kilovolt UHVDC line to carry solar- and wind-generated power from the high Tibetan plains to China’s center. That followed construction of a 1.1 million-volt cable that can transmit up to 12,000 megawatts of power, a bit more than the entire installed generation capacity of Ireland, from the deserts and mountains of Xinjiang province to the doorstep of Shanghai, almost 2,000 miles far away.

As countries phase out carbon to meet climate goals, they’ll have to spend at least $14 trillion to strengthen grids by 2050, according to Bloomberg New Energy Finance. That’s only a little shy of projected spending on new renewable generation capacity and it’s increasingly clear that high- and ultra-high-voltage direct current lines will play a part in the transition.

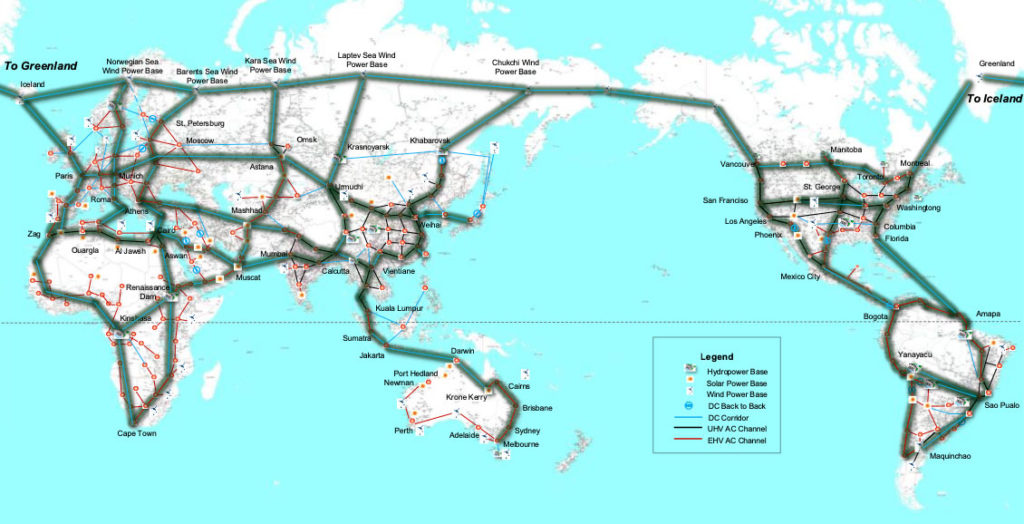

A schematic laying out Geidco’s vision of interconnected supergrids.

Source: UNFCCC

The effort of State Grid Corp. of China (SGCC), which chairs the Global Energy Interconnection Development and Cooperation Organization (GEIDCO), has been seen also on international market. Geidco’s phased plan starts by strengthening national grids and moves on to building regional networks, before finally, around 2070, completing construction of a full 18-channel Earth-spanning grid (see picture above). However, given the complexity of the project itself, very little progress has been achieved outside China. Of the total 125,000 km of high-voltage grids, which Geidco mapped in a 2019 report, very little has been built. The first stage of a Pakistan-China link, due to go live later this year, marks an exception.

HVDC cables can also make viable the construction of remote, power plant-size renewable installations on land. For instance, Mongolia’s Gobi desert is at the heart of the Northeast Asia supergrid project promoted both by China and Ohbayashi’s institute. In theory, the Gobi has potential to deliver 2.6 terawatts of wind and solar power—more than double the U.S.’s entire installed power generation capacity—to a group of Asian powerhouse economies that together produce well over a third of global carbon emissions.

If these supergrids don’t get built, it will be because their time has both come and gone. Not only are they expensive, politically difficult, and unpopular, their focus on mega-power installations seems outdated to some. Distributed microgeneration as close to home as your rooftop, battery storage, and transportable hydrogen all offer competing solutions to the delivery problems supergrids aim to solve.

Jan Vande Putte, a Brussels-based energy analyst for the environmental lobby Greenpeace, concurs. “All this will be needed, but none will be enough,” he says. “To integrate such large amounts of renewables into the grid, you can talk about battery storage and other things, but grid transfer is still the most cost-effective and efficient,” he says, adding that the EU and others are likely to move incrementally, with recognizable supergrids emerging only after 2030.

But, as the year 2030, is not really far from now, what Energy strategy and policy we shape in these day, it will form the way how we generate power in upcoming decades.

Sources:

www.bloomberg.com, www.research.db.com, www.patria.cz, www.oenergetice.cz, www.agora-energiewende.de, www.eia.org