Reverse repurchase agreements (reverse repos) are transactions in which an institution lends cash in exchange for financial assets sold by the owner of the financial assets at a given price under a commitment by the owner of the financial assets to repurchase the same (or identical) assets at a fixed price on a specified future date.

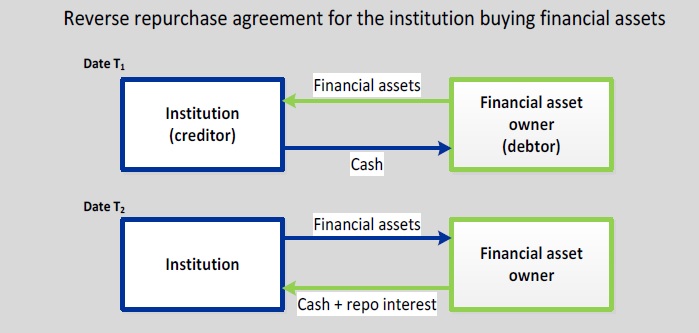

Broadly speaking, a reverse repurchase agreement is a transaction concluded on the deal date between two parties, the institution and the owner of the financial assets, in which:

- the owner of the financial assets sells a specified financial asset to the institution at an agreed price on date T1;

- the owner will repurchase the same (or identical) financial assets from the institution at a price agreed on the deal date on date T2 (after T1).

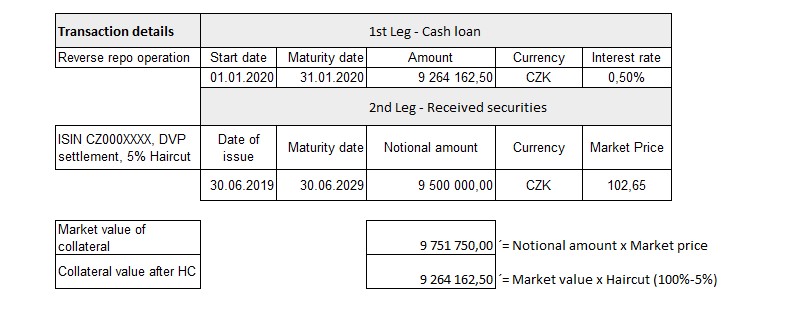

While the mechanics of a reverse repo involve selling and then repurchasing securities at a set price and a set time, at its financial essence, a reverse repo is in fact a collateralized loan. Another important aspect, when concluding the deal conditions, is the Haircut for collateral in form of Securities, for more details please refer to CSA Article.

Repo and Reverse Repo operations are broadly used on financial markets to cover temporary liquidity gaps or to simply gain ST-funding on roll-ver basis until the underlying securities are held till their maturity in the Balance sheet. Difference between Repo and Reverse repo transaction is just the direction of money flows, whereas in case of:

- Repo transaction – Citi sells the Securities (Bonds) to Deutsche and receives Cash funds from Deutsche, while

- Reverse repo transaction – Citi has liquidity excess and grants cash funds to Deutsche and receives the Securities for that.

A simplified description of Reverse repo operation is herewith attached:

During the times of financial shortage on money market, it is usual role of Central banks to supply the market with liquidity by means of Repo operations. In this case, Central Bank receives securities and provides ST-loans to commercial banks, and this is concluded based on Repo-rate, which is officially announced by Central bank. Such repo-rate is important indicator for banking sector liquidity, as well.

Repo operations are however regular trading activities also during the period, when the markets are stable. And this is due to the fact that financial institutions (incl. banks, insurance companies, mutual funds etc.) place certain amount of their available funds into government Bonds, Treasury Bills and other very liquid securities in order to keep necessary buffer as well as to fulfill required liquidity ratios (e.g. Liquidity Coverage ratio, “LCR”). Nevertheless, especially in case of holding these securities until the final maturity, these funds are “parked” for a quite long period and financial entities cannot use them. Therefore, repos represent additional benefit as holder of such securities may convert them into cash, which can be further used until the repo transaction matures, when sold securities must be purchased back.

On Czech market, the main supplier of liquidity role is naturally carried-out by Czech National Bank, which provides ST-funds in form of two weeks repo operations, on regular basis (more info to be found here). Current refinancing rate has been set at 2W Repo rate + 10BPS and usual haircut for securities (and their purchase price) received is 2% in case of T-Bills and CNB Notes, respectivelly 4% for other accepted papers. From CNB point of view, these repo operations are considered as technical operations (and not the lending one).

During the 1st pandemic wave at the beginning of 2020, CNB reacted with its monetary policy in order to keep domestic business running and performing well. In this respect the Repo rates were decreased to minimum level of 0,50% p.a. and stayed there for some time. However, as another problems started to accompany the economic slow-down during and after the 2nd wave of CV-19, especially increasing energy-prices, supply-chain shortages, unavailable labor forces etc., the inflation pressures have begun to prevail the fears from economy coolling, so that CNB had to respond with tightenning the monetary policy. As a result during the 2nd half of 2021, key interest rate for Repo operations was repeatedly increased, so that at the end of 2021 it stood at 3,75% p.a. (refer to official press release).