European Central Bank (ECB)

The ECB is an EU institution seated in Frankfurt am Main, Germany, established in 1998.

The ECB carries out specific tasks in the areas of banking supervision, banknotes, statistics, macroprudential policy and monetary policy as well as international and European cooperation. With regard to its monetary policy, the main objective is to maintain the price stability as a key component for increasing economic welfare and the growth potential of an economy. So, therefore ECB can use its monopoly position to set the rules influencing the monetary base (via money market rates for borrowing the money, orchestrated purchase of Government Bonds, via increasing the bank reserves etc.), whilst to keep the inflation target under control.

The main decision-making body is the Governing Council, which consists of the six members of the Executive Board plus the governors of the central banks of the 19 Euro area countries. Furthermore ECB has president and vice-president.

European System of Central Banks (ESCB)

The ESCB comprises of the ECB and the national central banks (NCBs) of all EU Member States whether they have adopted the single currency Euro or not. Further, Euro-zone credit institutions can receive central bank credit not only through monetary policy operations but exceptionally also through Emergency liquidity assistance (ELA). ELA aims to provide central bank money to solvent financial institutions that are facing temporary liquidity problems, outside of normal Eurosystem monetary policy operations.

The rules and procedures surrounding the provision of ELA are laid down in the ELA agreement (see below Attachment), which sets out the Governing Council’s role in the provision of ELA by national central banks (NCBs), in particular when assessing, pursuant to Article 14.4 of the Statute of the European System of Central Banks (ESCB) and of the ECB, whether the provision of ELA by Eurosystem NCBs interferes with the objectives and tasks of the ESCB.

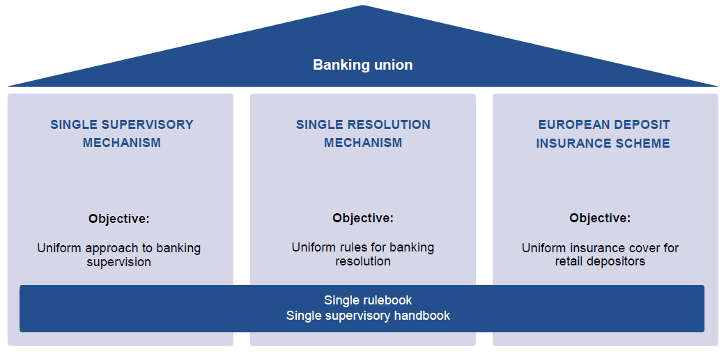

Banking union

It can be explained as the transfer of responsibility for banking policy from the national to the centralised EU level. The banking union is an important step towards a genuine Economic and Monetary Union. It allows for the consistent application of EU banking rules in the participating countries. The new decision-making procedures and tools help to create a more transparent, unified and safer market for banks. The need for a banking union emerged from the financial crisis of 2008 and the subsequent sovereign debt crisis. It became clear that, especially in a monetary union such as the Euro-zone, problems caused by close links between public sector finances and the banking sector can easily spill over national borders and cause financial distress in other EU countries. The banking union mainly consists of two main initiatives:

1) Single rulebook

2) Single Supervisory Mechanism

Single rulebook

The single rulebook is a name for the EU laws that collectively govern the financial sector across the entire European Union. European banking legislation was previously based on Directives which left room for significant divergences in national rules. This has led to different interpretations of those rules and to legal uncertainty; moreover, the financial crisis has shown that in integrated financial markets, these divergences can have very disruptive effects.

The Single Rulebook aims to provide a single set of harmonised prudential rules which institutions throughout the EU must respect. The term Single Rulebook was coined in 2009 by the European Council in order to refer to the aim of a unified regulatory framework for the EU financial sector that would complete the single market in financial services. This will ensure uniform application of Basel III in all Member States. It will close regulatory loopholes and will thus contribute to a more effective functioning of the Single Market.

In fact, it was European Banking Authority (EBA) that played a key role in building up of the Single Rulebook in banking sector. The EBA is mandated to produce a large number of Binding Technical Standards (BTS) for the implementation of the CRD IV package, the BRRD, the DGSD, the PSD2 and MCD. BTS are legal acts which specify particular aspects of an EU legislative text (Directive or Regulation) and aim at ensuring consistent harmonisation in specific areas. BTS are always finally adopted by the European Commission by means of regulations or decisions. At that point they become legally binding and directly applicable in all Member States.

Single Supervisory Mechanism

One pillar of the banking union is the Single Supervisory Mechanism (SSM), which would grant the European Central Bank (ECB) a supervisory role to monitor the implementation of the single rulebook and the financial stability of banks based in participating states.

Its main aims are to:

– ensure the safety and soundness of the European banking system;

– increase financial integration and stability;

– ensure consistent supervision.

The Single Supervisory Mechanism (SSM) is the legislative and institutional framework that grants the European Central Bank (ECB) sole licensing authority over all banks in participating EU member states (except branches of banks from non-EEA countries) and makes it the prudential supervisor of these banks, directly for the larger ones and indirectly for the smaller. Eurozone countries are required to participate, while participation is voluntary for non-eurozone EU member states. The ECB directly supervises the 117 significant banks of the participating countries. These banks hold almost 82% of banking assets in the euro area.

Single Resolution Mechanism

Another (second) pillar of the banking union, the single resolution mechanism (SRM) is a central institution for bank resolution in the EU, and one of the pillars of the banking union.

Resolution is the orderly restructuring of a bank by a resolution authority when the bank is failing or likely to fail. This procedure ensures that a bank failure does not harm the broader economy or cause financial instability.

If any bank fails, despite stronger supervision, the SRM allows bank resolution to be managed effectively through:

– a single resolution board;

– a single resolution fund that is financed by the banking sector.

The Single Resolution Board (SRB) was established in 2014 by Regulation (EU) No 806/2014 on the Single Resolution Mechanism (SRM Regulation) and began work on 1 January 2015. It became fully responsible for resolution on 1 January 2016 and was henceforth the resolution authority for around 143 significant banking groups as well as any cross border banking group established within participating Member States.

European deposit insurance scheme

In November 2015 the Commission proposed to set up a European deposit insurance scheme (EDIS) for bank deposits in the euro area. EDIS is the third pillar of the banking union. This proposal was adopted as a part of a broader package of measures to deepen the economic and monetary union, and complete the banking union.

The EDIS proposal builds on the system of national deposit guarantee schemes (DGS) regulated by Directive 2014/49/EU. This system already ensures that all deposits up to €100 000 are protected through national DGS all over the EU.

EBA and other Supervisory authorities

The European Banking Authority (EBA) is an independent EU Authority which works to ensure effective and consistent prudential regulation and supervision across the European banking sector. Its overall objectives are to maintain financial stability in the EU and to safeguard the integrity, efficiency and orderly functioning of the banking sector. The EBA was established on 1 January 2011 as part of the European System of Financial Supervision (ESFS) and took over all existing responsibilities and tasks of the Committee of European Banking Supervisors.

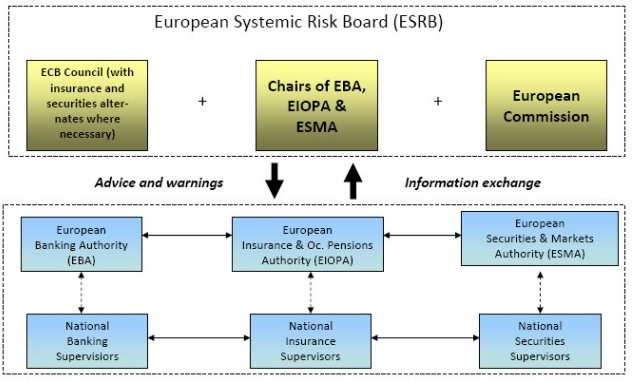

Macro-prudential supervision involves oversight of the financial system as a whole. Its main aim is to prevent or mitigate risks to the financial system. The European Systemic Risk Board (ESRB) is responsible for macro-prudential supervision of the financial system in the EU. The roles of main supervisory authorities within ESRB is depicted in attached diagram:

The main tasks of the ESRB are:

(i) collecting and analysing relevant information to identify systemic risks

(ii) issuing warnings where systemic risks are deemed to be significant

(iii) issuing recommendations for action in response to the risks identified

(iv) monitoring the follow-up of warnings and recommendations

(v) cooperating and coordinating with European Supervisory authorities (ESAs) and international forum.

Micro-prudential supervision refers to the supervision of individual institutions, such as banks, insurance companies or pension funds. The European system set up for the supervision of the financial sector is made of three supervisory authorities: the European Securities and Markets Authorities (ESMA), the European Banking Authority (EBA) and the European Insurance and Occupational Pensions Authority (EIOPA). For instance, see attached EBA report on Credit risk benchmarks in EU banking sector:

The ESAs work primarily on harmonising financial supervision in the EU by developing the single rulebook, a set of prudential standards for individual financial institutions. The ESAs help to ensure the consistent application of the rulebook to create a level playing field. They are also mandated to assess risks and vulnerabilities in the financial sector.

European Securities and Market Authorities

ESMA was founded as a direct result of the recommendations of the 2009 de Larosière report which called for the establishment of a European System of Financial Supervision (ESFS) as a decentralised network. It began operations on 1 January 2011 according to its Founding Regulation and replaced the Committee of European Securities Regulators (CESR) which was a network of EU authorities which promoted consistent supervision across the EU and provided advice to the European Commission. Whilst ESMA is independent, there is full accountability towards the European Parliament where it appears before the Economic and Monetary Affairs Committee (ECON), at their request for formal hearings. Full accountability towards the Council of the European Union and European Commission is also maintained.

ESMA achieves its mission and objectives through four activities:

- Assessing risks to investors, markets and financial stability

- Completing a single rulebook for EU financial markets

- Promoting supervisory convergence

- Directly supervising specific financial entities

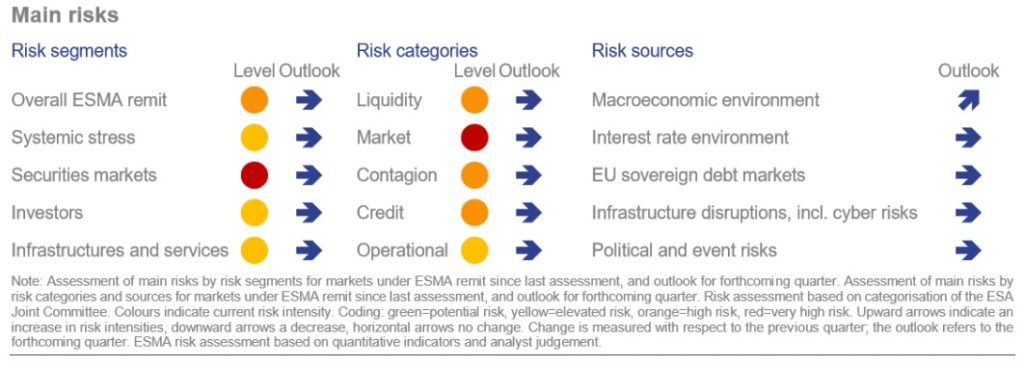

The purpose of assessing risks to investors, markets and financial stability is to spot emerging trends, risks and vulnerabilities, and where possible opportunities, in a timely fashion so that they can be acted upon. ESMA uses its unique position to identify market developments that threaten financial stability, investor protection or the orderly functioning of financial markets. ESMA’s risk assessments build on and complement risk assessments made by other European Supervisory Authorities (ESAs) and National Competent Authorities (NCAs), and contribute to the systemic work undertaken by the European Systemic Risk Board (ESRB), which increasingly focuses on stability risks in financial markets. Internally, the output of the risk assessment function feeds into ESMA’s work on the single rulebook, supervisory convergence and the direct supervision of specific financial entities. Externally, it promotes transparency and investor protection by making information available to investors via our public registries and databases and, where needed, by issuing warnings to investors. The risk analysis function closely monitors the benefits and risks of financial innovation in EU. Below attached is an sample of Risk assessment regurarly performed by ESMA:

The purpose of completing a single rulebook for EU financial markets is to enhance the EU Single Market by creating a level playing field for investors and issuers across the EU. ESMA contributes to strengthening the quality of the single rulebook for EU financial markets by developing Technical Standards and by providing advice to EU Institutions on legislative projects. This standard setting role was the primary task of ESMA in its development phase.

Supervisory convergence is the consistent implementation and application of the same rules using similar approaches across the 28 Member States. The purpose of promoting supervisory convergence is to ensure a level playing field of high quality regulation and supervision without regulatory arbitrage or a race to the bottom between Member States. The consistent implementation and application of rules ensures the safety of the financial system, protects investors and ensures orderly markets. Supervisory convergence implies sharing best practices and realising efficiency gains for both the NCAs and the financial industry. This activity is performed in close cooperation with NCAs. ESMA’s position in the ESFS makes it qualified to conduct peer reviews, set up EU data reporting requirements, thematic studies and common work programs, draft opinions, guidelines and Q&As; but also build a close network that can share best practices and train supervisors. ESMA’s participation in supervisory colleges for Central Counterparties (CCPs) contributes to supervisory convergence for this specific area. ESMA actively supports international supervisory coordination.

ESMA is the direct supervisor of specific financial entities: Credit Rating Agencies (CRAs) and Trade Repositories (TRs). These entities form essential parts of the EU’s market infrastructure. ESMA’s four activities are closely linked. Insights gained from risk assessment feed into the work on the single rulebook, supervisory convergence and direct supervision, and vice versa.

source: www.esma.Europa.eu, www.ECB.Europa.eu