A simplest conversion of two currencies (e.g. EUR/CZK) based on current FX-rate, without any impact of future market prices. Having said that, it means that Spot deal is concluded and settled on same day value (resp. depending on practical settlement standards for each currency). Actually, FX-spot conversion is not a Derivative but it serves as basis resp. 1st Leg within Derivatives transactions.

From risk point of view, it does not utilize the Delivery limit, just the Settlement limit in case that Citi sells CZK 5.1Mio to Deutsche first and wait for incoming payments of EUR 200tsd. from Deutsche’s correspondent A/C (meaning that transaction is not settled within the “house”, but through A/C held with another Bank). So, in this case, it may happen that EUR funds will not arrive on the same day from Deutsche which reflects purely the Settlement risk.

This can be easily mitigated by applying the Delivery after payment clause, which gives a Citi possibility to wait for incoming payment first, and after this is received on Citi’s A/C, then CZK funds can be sent to Deutsche. Quite obviously, it is a matter of mutual trust between the Banks and depends on quality of liquidity management of each counterparty.

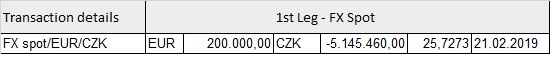

Details of the deal can be seen below.

Example from practice:

Czech-based IKEA subsidiary needs to pay to its foreign Suppliers for Goods imported from Austria for instance, it has enough cash-funds on CZK A/C as IKEA is Czech-based retailer incurring income from sales in domestic currency, but does not have currently enough EUR liquidity, because it has recently distributed Dividends to IKEA AB in EUR. So that simple FX-Spot conversion between CZK and EUR will lead to debiting IKEAs CZK A/C and crediting EUR A/C and payment for Goods may be sent immediately to foreign trading partner in Austria. Transaction is closed and settled on same day.