Nowadays, the banking sector is one of the most regulated industry in the world. However, until the 1970s it was not so and hence after serious disturbances on international financial markets, at the end of Year 1974 it was decided to establish Basel Committee on Banking Supervision (originally named the Committee on Banking Regulations and Supervisory Practices). This Basel Committee consisted of Central banks Governors of the G-10 most developed countries.

The main goal of the committee was to enhance financial stability by improving the quality of banking supervision worldwide, and to serve as a forum for regular cooperation between its member countries on banking supervisory matters.

Basel I.

As a result of discussion and intensive work was published a set of minimum capital requirements for banks. This is also known as the 1988 Basel Accord, and was enforced by law in the Group of Ten (G-10) countries in 1992.

Originally, this concept dealt only with Credit risk as the period between 1960-1985 remained intact of any global financial crises, as there were no bigger market turbulences, so that Banks were exposed mainly to the risk of losses from deteriorating of the Credit profile of their Clients originated within Banking portfolio. Following the first occurrences of larger Sovereign Defaults that had severe impact on global markets (Government Bonds of Mexico, Russian and Malaysia) and later on Long-Term Capital Management Fund near-bankruptcy, the regulatory Bodies came to conclusion that market risks were somehow underestimated and needed to be incorporated as well (investment and trading portfolio concept), which were adopted in 1996.

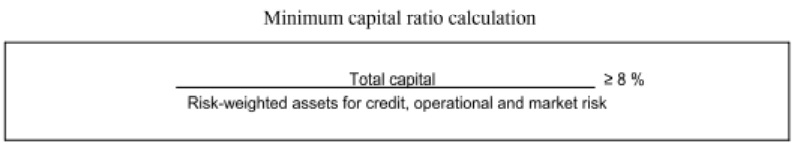

Naturally, the main discussions preceding to ratification of The Basel Accord, were dedicated to question, how much of the Capital vs. risk-weighted assets should every Bank keep aside to absorb the turmoil on financial markets in order to avoid the needs for central banks bailout. This agreed minimum level of Capital was given a new term – Capital Adequacy, that will become main financial parameter in the consideration of financial health of each Bank.

The required Capital adequacy ratio was set for 8% at least, and it was calculated as Total Capital (Tier1+Tier2) against Risk weighted assets, whereas each Assets category was assigned its own Risk weights from 0% to 100% depending on the rating of the counterparty, commitment, pay-out probability etc. Tier 1 Capital was referring to Registered capital and Retained Earnings, while Tier 2 was connected with Supplementary Capital funds. What is clear from diagram above, this minimum level of 8% remained unchanged during the following update of Basel Requirement (Basel I – II), just the additional elements have been implemented to capture all existing risks incl. market and operational one.

In general Basel I outlined the major principles and foundation for regulatory measuring the risk on financial markets and further updates were adopting this policy on latest trends and increasing complexity of threats surfacing in late years of 20-th century, that was typical for lot of uncertainties about future direction and evolution of financial markets.

In the Czech Republic, it was applied in the 1990s and incorporated into the Czech Act on Banks (21/1992 Coll.), Measure of CNB No. 3/1999 and Decree No. 333/2002.

Basel II.

Modern era of financial industry brought up pretty more complexity, sophisticated structures, larger volumes for deals and unclear risks connected with Derivatives trading. Actually, the fall of LTCM Hedge fund in 1998 revealed the unsuspected possibilities to create a multi-layers of connected Derivative deals (mainly Repos) using Leverage of more than 25x-to-1, which effectively from share capital of USD 5bln pilled-up to the open risk position of more than USD 1,000bln (when trading also USD 130bln of assets under management received from another Banks)1, which in the end represented a system risk for whole banking industry and could cause an domino effect on important market participants. As a result of this, and to solve it without any big impact on market stability, FED was forced to step-in and to coordinate financial bail-out of LTCM by all the Banks that acted as potential creditors. Nevertheless, this was a warning signal, that new amendments into Basel I concept are needed.

For more details, please read this article:

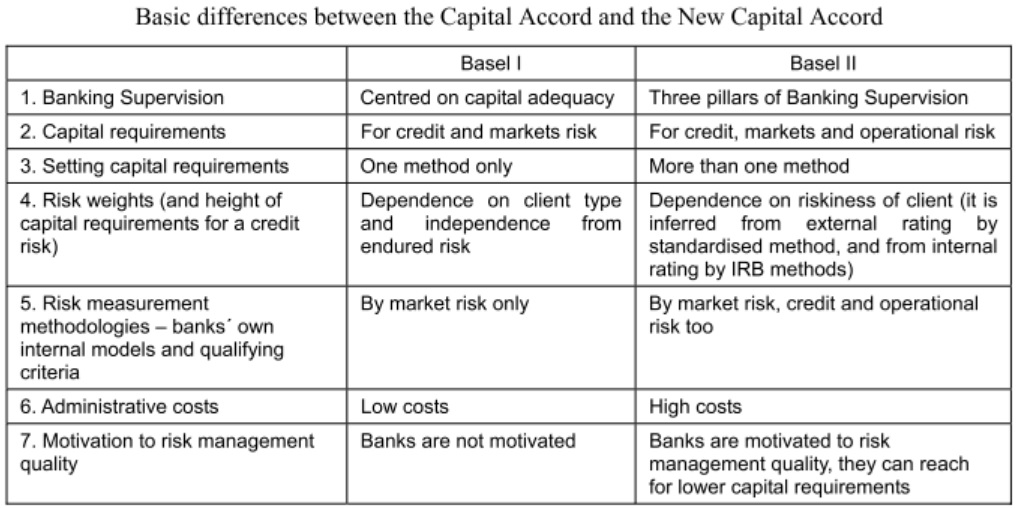

A new capital framework was released in 2004 replacing the 1988 Accord and revised regulation, below attached is the simplified overview of main differences between both concepts. 2

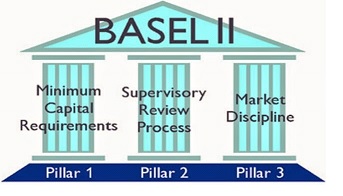

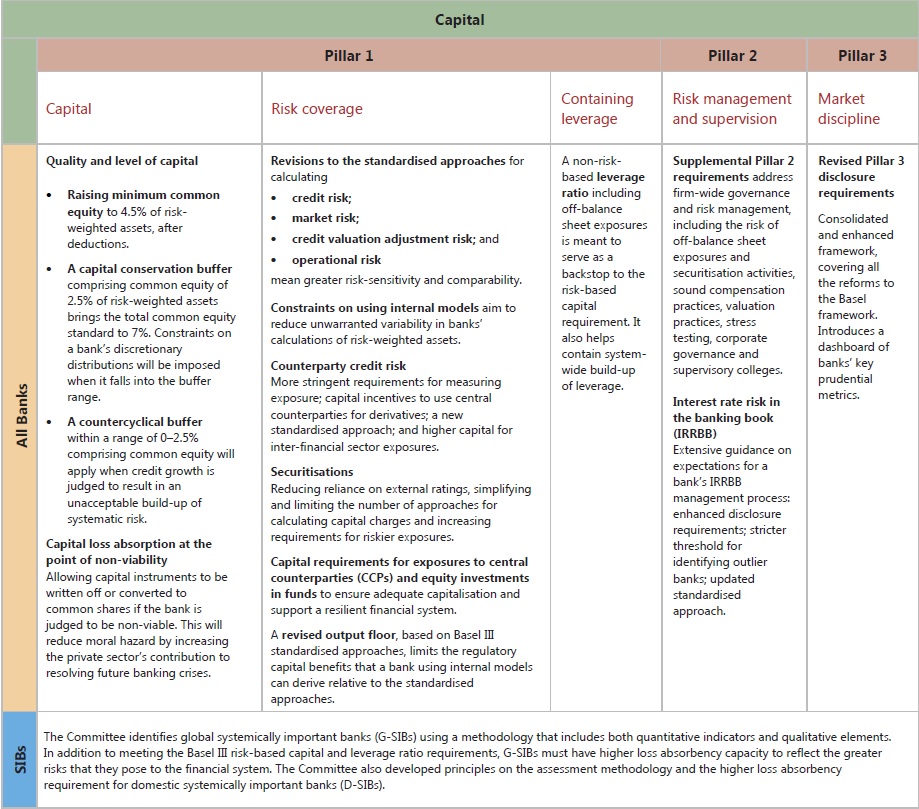

Basel II newly comprised of three pillars, see below attached picture and its description for details. The scope of main issues identified within updated Basel concept was dealing with following areas:

a) minimum capital requirements, which sought to develop and expand the standardized rules on risk measurement including the banks own internally developed models

b) supervisory review of an institution’s capital adequacy and internal assessment process (ICAAP, additional market risks like Value at Risk (VaR)) and sound internal controlling mechanisms

c) effective use of disclosure as a lever to strengthen market discipline and encourage sound banking practices (information obligation on risk measurement and applied methods etc.)

One of the key point, Basel II brought to banks, is the fact that credit risk component 3 can be calculated based on following:

1. Standardized Approach (SA) – It is the simplest method. The risk weights are derived from ratings set by external credit assessment institutions or export credit agencies.

2. One of two internal ratings-bases (IRB)

2.a) IRB Approach (IRB) – By the method bank uses own estimates of the probability of default of its client and banking supervisory authorities determine the other characteristics.

2.b) Advanced IRB approach (AIRB) – All the components are determined by bank internal methodology and Risk policy including Probability of default, LGD, Client`s rating etc. based on historical parameters derived from its own Lending portfolio. This method became commonly used among the commercial banks, as reliance on external rating in case of SA model makes sense only in developed economic environment, whereas Rating agencies are able to cover majority of Clients on-boarded in the portfolio.

Further, regarding the operational risks, the Banks can use one of four basic methods:

1. Basic indicator approach (BIA) – Calculation of the capital charge as a fixed percentage of the bank’s net income.

2. Standardized approach (STA) – Calculation of the capital charge separately for each business line, as a fixed percentage.

3. Alternative standardized approach (ASA) – banking supervisory authority may allow bank to use another alternative indicator for commercial or retail banking business lines.

4. Advanced measurement approaches (AMA) – Banks are allowed to use their own various internal methods and models. The methods and models have to be approved by the supervisory authority.

In the Czech republic the regulation applied from 1 July 2007 (Decree No.123/2007 Coll.), for details, pls refer to Attachment:

Basel III

Not only financial crisis in 2007/2008 proved the needs for a fundamental strengthening of the Basel II framework. The banking sector suffered at the time of financial crisis too much leverage and inadequate liquidity buffers. These weaknesses were accompanied by poor governance and risk management, as well as inappropriate incentive structures.

The dangerous combination of these factors was demonstrated by the mispricing of credit and liquidity risks, and excess of credit growth.

This document, originally published in December 2010 and updated in June 2011 (to reflect a minor modification to the credit valuation adjustments applied to address counterparty credit risk in bilateral trades) represents the initial phase of Basel III reforms, which focused on strengthening the following components of the regulatory framework:

- improving the quality of bank regulatory capital by placing a greater focus on going-concern loss-absorbing capital in the form of Common Equity Tier 1 (CET1) capital;

- increasing the level of capital requirements to ensure that banks are sufficiently resilient to withstand losses in times of stress;

- enhancing risk capture by revising areas of the risk-weighted capital framework that proved to be actually miscalibrated, including the global standards for market risk, counterparty credit risk and securitization;

- adding macro prudential elements to the regulatory framework, by: (i) introducing capital buffers that are built up in good times and can be drawn down in times of stress to limit pro-cyclicality; (ii) establishing a large exposures regime that mitigates systemic risks arising from interlinkages across financial institutions and concentrated exposures; and (iii) putting in place a capital buffer to address the externalities created by systemically important banks; and

- specifying a minimum leverage ratio requirement to constrain excess leverage in the banking system and complement the risk-weighted capital requirements.

Here are updated releases of Basel III Framework incl. underlying working papers:

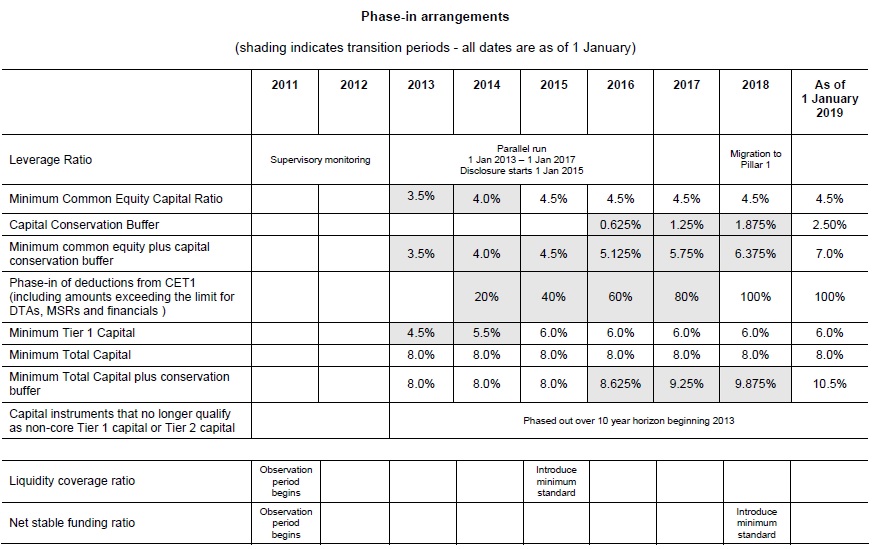

So, besides regulatory capital incl. all buffers, which is newly expected to be at level of 10,5% (CET1 + additional capital conservation buffer to be at 7%) also additional prudential ratios have been implemented, which should provide enhanced guidance on measuring the risks. Among others, these are CVA (Credit valuation adjustment), Liquidity coverage ratio, Net Stable Funding ratio etc. Most of the Capital regulations were originally phased in period between 2013 and 2019, for details see below attached diagram:

Amendments relate mainly to these indicators:

- Capital ratios – improving the quality and quantity of regulatory capital, in particular reinforcing the central role of common equity Tier 1 capital (CET 1), additional Tier 1 capital (AT1)

- Capital buffers – countercyclical capital buffer, systemic risk buffer, capital conservation buffer, Global systemically important banks (SIB – see explanation in below attached picture) buffer representing Add-ons to Common Equity to withstand various crisis scenarios

- Leverage ratio – a minimum amount of loss-absorbing capital relative to all of a bank’s assets and off-balance sheet exposures regardless of risk weighting

- Liquidity requirements – a minimum liquidity ratio, the Liquidity Coverage Ratio (LCR), intended to provide enough cash to cover funding needs over a 30-day period of stress; and a longer-term ratio, the Net Stable Funding Ratio (NSFR), intended to address maturity mismatches over the entire balance sheet and

- additional requirements for systemically important banks, including additional loss absorbency and strengthened arrangements for cross-border supervision and resolution

Modified Pillars 1-3 under Basel III agenda:

sources: www.BIS.org, www.thebankexamstoday.com, www.wikipedia.org, Banks and Bank Systems Journal by Business Perspectives

References: 1/ Barry Ritholz – „Before the GFC there was LTCM…“, published in October 2018 2/ Ivana Valová – „New Capital Rules According to Basel II”, published in July 2007 3/Moodys Analytics – „Regulation guide“, published March 2011